|

|

||||

|

Thursday Oct 18

|

|||

| |

||||

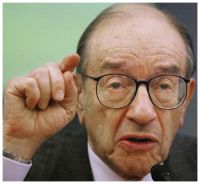

Greenspan acknowledges sub-prime slipby Gaganjot Singh - September 15, 2007 - 0 comments

Former Federal Reserve chief Alan Greenspan says he had few means to contain the spread of subprime mortgages. In excerpts released yesterday of an interview with the CBS 60 Minutes program to be broadcast on Sunday, Former Federal Reserve Chairman Alan Greenspan acceeded that he failed to recognize early on that the outburst of sub-prime mortgages to people with ambiguous credit histories or low incomes could pose a danger to the economy. The 81 year old Mr. Greenspan said he underestimated the impact of the subprime mortgage crisis that will soon see millions of Americans forced from their homes. He said, "While I was aware a lot of these [questionable lending] practices were going on, I had no notion of how significant they had become until very late”. He said that he realized this in 2005-2006 as he was preparing to step down. Mr. Greenspan, who ran the central bank for 18 years, retired last year. As Fed chief, Greenspan's handling of the economy earned him laudatory monikers including maestro, the greatest central banker who ever lived and the second-most-important person in Washington. The Fed Cheif has received a lot of acclaim for leading the economy to its longest expansion in the 1990s and many economists have praised his handling of a sequence of crises. Yet some critics speculate whether the Greenspan could have done more to prevent careless lending standards, bad loans and other problems that have since come to light in the higher-risk sub-prime mortgage market. Wall Street has been staggered by a meltdown in that market. Foreclosures and late payments have increased and many lenders have gone out of business. Nervous financial institutions have constricted credit standards, making getting finance, an arduous task, even for credit worthy borrowers. This has increased the risk that the economy will slide into a recession. Mr. Greenspan who is also known in economic circles as the "Bubble King" for the way he manipulated interest rates during several economic crises over his long tenure, the most recent when he lowered the Fed's key overnight lending rate after the dot-com meltdown in 2001 to 1%, which sparked the housing boom. The U.S. central bank's Federal Open Market Committee is widely expected to lower the benchmark rate by at least a quarter percentage point when it meets on Tuesday. Critics say the Fed kept rates too low for too long, encouraging a Wild West mentality in housing. Greenspan, however, defended the institution's actions. "They are mistaken," he said of the critics. "It was our job to unfreeze the American banking system if we wanted the economy to function. This required that we keep rates modestly low." In the CBS interview Mr. Greenspan says he feels Mr. Bernanke "is doing an excellent job", in response to certain critics who felt that he would have acted more aggressively than Bernanke in dealing with the current financial crisis. Mr. Greenspan has written a book, called The Age of Turbulence: Adventures in a New World, that looks back on his life and his days as Fed chief. The book releases on Monday. |

|

||||||

Disclaimer: The views and investment tips expressed by investment experts on themoneytimes.com are their own, and not that of the website or its management. TheMoneyTimes advises users to check with certified experts before taking any investment decision. ©2004-2007 All Rights Reserved unless mentioned otherwise. [Submit News/Press Release][Terms of Service] [Privacy Policy] [About us] [Contact us] |